Objective

Debt fund primarily secured by first-level land/property mortgages.

Features

First mortgage | Loan-to-value ratio not exceeding 70% | Comprehensive risk control system | Collective mortgage loan fund

Objective

Debt fund primarily secured by first-level land/property mortgages.

Safety

IAFM holds a license from the Australian Securities and Investments Commission (ASIC) and an Australian credit license. Investor funds and mortgages are held by an independent ASIC-licensed custodian.

Market Advantages

Why is Australia Worth Investing In?

Australia is a wealthy and developed country with a stable economy and a mature financial market, considered one of the most robust financial systems in the world.

The Australian government supports foreign direct investment, values individual asset rights, and provides a stable and transparent policy and legal environment for investors. For certain investment sectors, Australia offers tax incentives to attract foreign investors.

Australia is a major global exporter of minerals and natural resources, with abundant mineral reserves. There are also rich investment opportunities in sectors such as education, tourism, agriculture, and technological innovation. The real estate market has shown long-term stable growth.

Australia has close trade relationships with China and other Asian economies, offering investors opportunities to use Australia as a gateway to the Asian market. Additionally, the minimal time difference with Asian markets facilitates real-time trading and communication.

Australia has one of the most transparent and fair legal systems in the world.

Australia welcomed over 500,000 immigrants in 2023, and this trend is expected to continue in 2024.

Australia has signed 18 Free Trade Agreements (FTAs), ensuring broad market access.

Australia's rental vacancy rate is at a historic low, reflecting strong demand and a tight market.

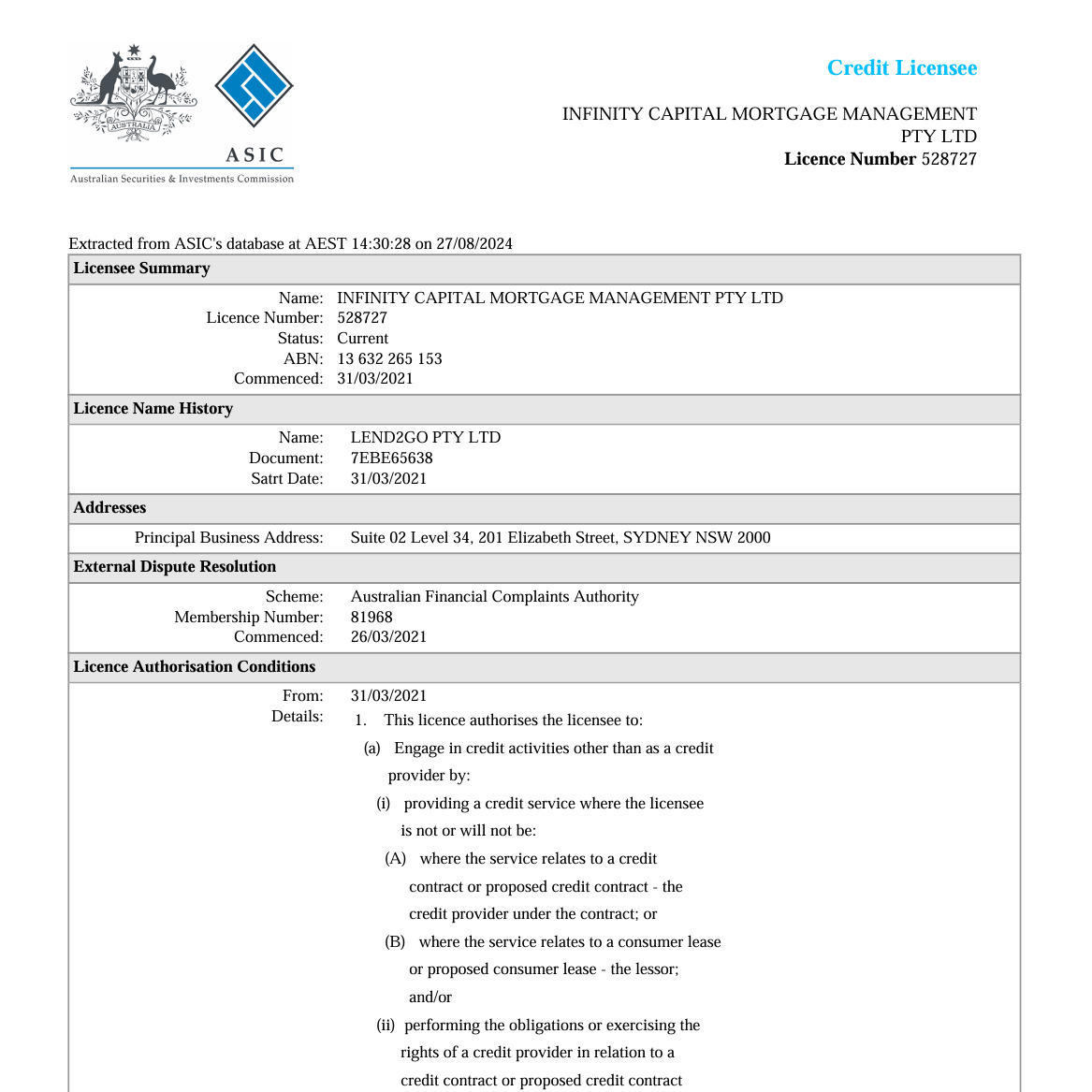

金融放贷牌照ACL

Australian Credit License (ACL)

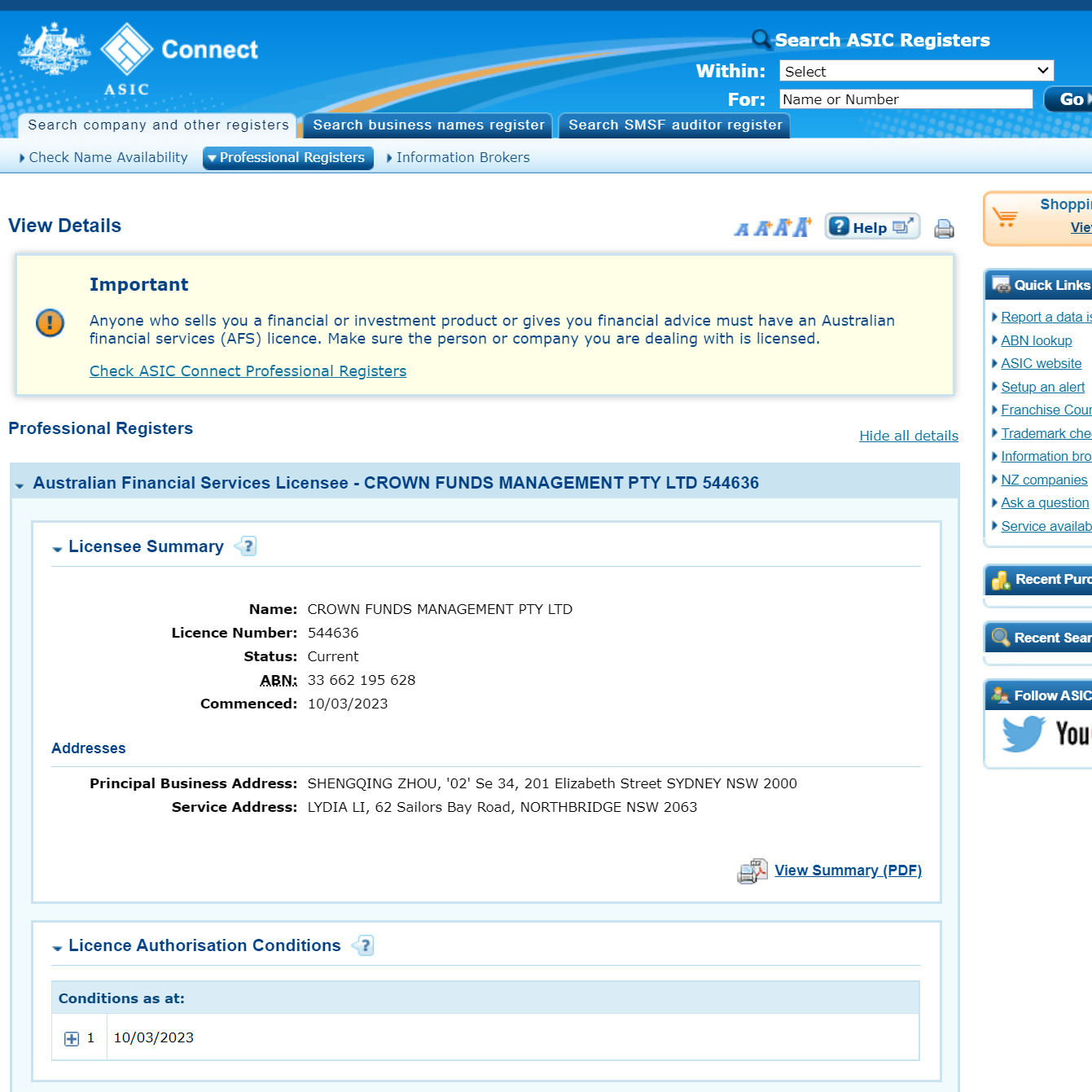

澳大利亚基金牌照AFSL

Australian Financial Services License (AFSL)

金融贷款协会FBAA会员

Member of the Finance Brokers Association of Australia (FBAA)

Financial License

Regulation and Security

Infinity Alpha Funds Management safeguards your investment.

-

An international provider of corporate trustee solutions for the financial services industry.

-

Providing professional custodial and trustee services for over 130 years.

-

Branches established in international financial centers such as New York, London, HongKong and Sydney.

-

Over $35 billion in assets under custody.

-

Over 400 active trust operations.

www.certane.com

Advantages of the Custodian Bank

-

Ensures assets are appropriately segregated from other trust assets to protect the investment portfolio for investors.

-

Allows trustees and custodians to focus on fund management, increasing investor confidence and assisting in marketing the fund to investors.

-

Leverages the scale of the custodian to minimize transaction costs and maximize operational efficiency.

Partners

Partnership

Infinity Alpha Funds Management collaborates with numerous partners to provide you with high-quality services.

Our customer success stories

Discover how businesses like yours transformed with our software. Real stories of growth, innovation, and success.

Identifying growth opportunities for Prosper: financial strategies

Helping SummitEdge navigate challenges: regulatory compliance

Improving EvolveVision efficiency: streamlining processes

Tangible results shared here

Discover how our financial expertise transformed businesses like yours, delivering exceptional results and growth.

Helped navigate regulatory challenges. Valued advisors for strategic financial decisions.

Frederic Hill

Founder & CEO

Increase in customer growth rate

Stellar support in navigating market complexities. Trusted partners for financial growth.

Safaa Sampson

Account Executive

Saved in operational costs

Innovative solutions tailored to our needs. A reliable partner for our financial excellence.

Brendan Buck

Business Manager

Increase in company revenue

Help center

Got a question?

Get your answer

Quick answers to questions you may have. Can't find what you're looking for? Get in touch with us.

Our consulting optimizes strategies for sustainable growth and improved financial performance.

Let's connect

We’re here to help

Need help with a project, have a question about our work? We’re here.

An insightful consulting firm with an engaged team, offering solutions blending analytics and creativity.

Alex Willson

Founder & CEO